How Trust, Consumer Expectations, and Real-Time Insight Are Reshaping Health Plans

Patient experience intelligence for payers is becoming a strategic necessity as trust erodes, consumer expectations rise, and regulatory pressure intensifies.

Health plans are in the eye of the storm.

Regulation is shifting underfoot, payment friction is increasing, AI pilots are everywhere, and members are behaving more like retail consumers than ever before. At Becker’s Fall Payer Issues Roundtable, one executive described the moment as “the intersection of the super slow and then zoom, it’s getting really crazy fast,” as ACA subsidies change, Medicaid redeterminations continue, and Medicare Advantage faces heightened oversight.

Across all of this, one theme keeps resurfacing in payer boardrooms, conference panels, and member research.

Trust and experience.

Payers often describe themselves as “data rich, insight poor.” Members describe their experience differently, with words like “confusing,” “fragmented,” and “hard to trust.”

That disconnect is exactly why patient experience intelligence for payers is emerging as a strategic priority.

At its core, experience intelligence puts member and patient experience on the same footing as cost and clinical quality, using data payers already have access to, but rarely use well.

Most plans already have strong foundations:

- Claims and utilization data

- Quality and Star Ratings reporting

- CAHPS and internal survey programs

- VOC and NPS tools tied to call centers and digital channels

All of this matters. It is also largely backward-looking and fragmented. Experience intelligence is the missing layer that sits across these systems and answers three questions in close to real time:

- What are members and their families actually experiencing as they move through our network?

- Where are trust and experience at risk, before those issues surface in Stars, complaints, or leakage?

- Which providers, service lines, or markets offer the biggest opportunity for impact if we act now?

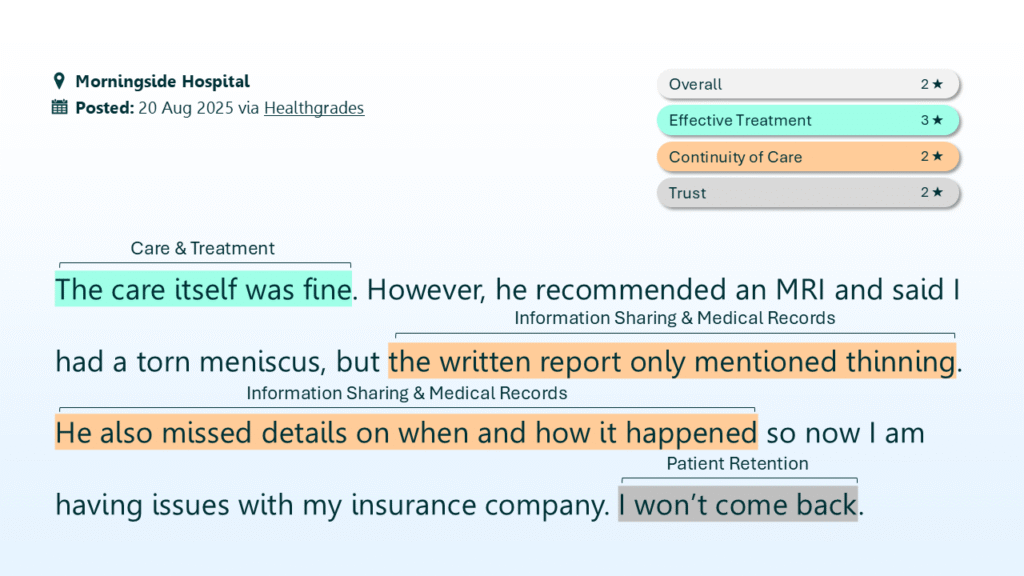

Using AI models trained on healthcare language, PEP Health analyzes millions of unsolicited patient and family reviews, classifies them into seven experience domains, and generates standardized PEP Scores and Trust Scores across more than 350,000 healthcare locations in the US. These scores are validated against HCAHPS and CMS Star Ratings and update continuously rather than once a year.

For payers, that means experience can shift from something reviewed months after the fact to a measurable, leading indicator managed alongside quality and cost. The current market context makes that shift urgent.

PEP Health Classifies and Scores Feedback to Generate a Unique PEP Score and Trust Score for Every Healthcare Facility

Trend 1: Data rich, insight poor

Payers are investing heavily in advanced analytics, digital twins, and AI-driven risk models. They are using real-world data to test scenarios and refine care management strategies. Yet when the conversation turns to member and patient experience, the picture remains incomplete.

Most plans still rely on:

- Regulatory surveys that arrive long after the performance year

- Point solution VOC tools focused on a single channel

- Anecdotal feedback from providers, brokers, or complaint logs

Meanwhile, members and families leave detailed, time-stamped feedback every day in public reviews and forums, describing where access breaks down, how prior authorization feels in practice, and why they do or do not trust a provider or system.

Those signals rarely make it into payer decision-making in a structured way. The result is familiar: leaders sense problems in certain markets or products but lack the clarity and lead time to act decisively. Experience intelligence closes that gap by turning unstructured narrative into stable, comparable metrics that allow plans to benchmark network experience, track trends monthly rather than annually, and pair real stories with quantitative insight that boards and regulators can understand.

Trend 2: The trust gap, especially in Medicare Advantage

J.D. Power’s 2025 U.S. Medicare Advantage Study puts hard numbers behind what many plans are feeling. The report shows a year-over-year decline in overall satisfaction, driven primarily by a 39-point drop in members’ stated trust in their Medicare Advantage plan. Confusion around benefits, networks, and prior authorization emerged as key drivers.

At the same time, J.D. Power found wide gaps between high-performing and low-performing plans, particularly in onboarding, communication, and digital engagement.

Trust is not abstract in this context. It influences:

- Whether members stay with a plan at renewal

- Whether utilization management is perceived as support or obstruction

- How members respond to benefit and network changes under regulatory scrutiny

PEP Health’s Trust Score analysis reinforces this. Across millions of patient comments, trust is consistently driven by factors that matter deeply to payers: caring and compassion, clarity of information, involvement in decisions, and responsiveness when concerns arise. Trust also shows up in observable outcomes such as retention, willingness to recommend, and complaint volume.

For Medicare Advantage in particular, trust has become a strategic asset. But it cannot be managed effectively without a precise, repeatable way to measure it.

Trend 3: Consumerism and the rise of care navigation

Another strong theme from AHIP and Becker’s coverage over the past year is the shift from “engagement” to care navigation.

Plans are moving beyond reminders toward more orchestrated journeys that help members understand their options, choose appropriate sites of care, and stay aligned with evidence-based treatment plans. Executives increasingly compare these efforts to experiences in other consumer industries, where clarity and guidance are expected.

Members already behave this way when choosing providers. They compare reviews, look for social proof, and avoid providers with poor reputations, even when those providers are in network. The challenge is that this consumer view of the network is often disconnected from how plans themselves see it.

- Members see public ratings and comments on Google, Healthgrades, and social platforms

- Plans see claims, quality scores, and survey results

Experience intelligence connects these views. By using the same data members rely on, but structuring it for network, Stars, and quality teams, plans can align navigation, directories, and tiering with actual experience on the ground.

Trend 4: Patient experience intelligence for payers as a financial and regulatory lever

At Becker’s Fall Payer Issues Roundtable, executives also highlighted how regulatory and financial pressures are converging.

- Tightened Medicare Advantage oversight around Stars, coding, and utilization

- ACA and Medicaid churn driven by subsidy changes and redeterminations

- Increased scrutiny of prior authorization and transparency

In parallel, providers are facing rising denial complexity and extended payment delays. An Ensemble Health Partners analysis of 80 million transactions, published by Becker’s, showed a 42 percent increase in Medicare Advantage inpatient denials and RFIs adding an average of 117 days to payment.

Experience sits directly inside this equation.

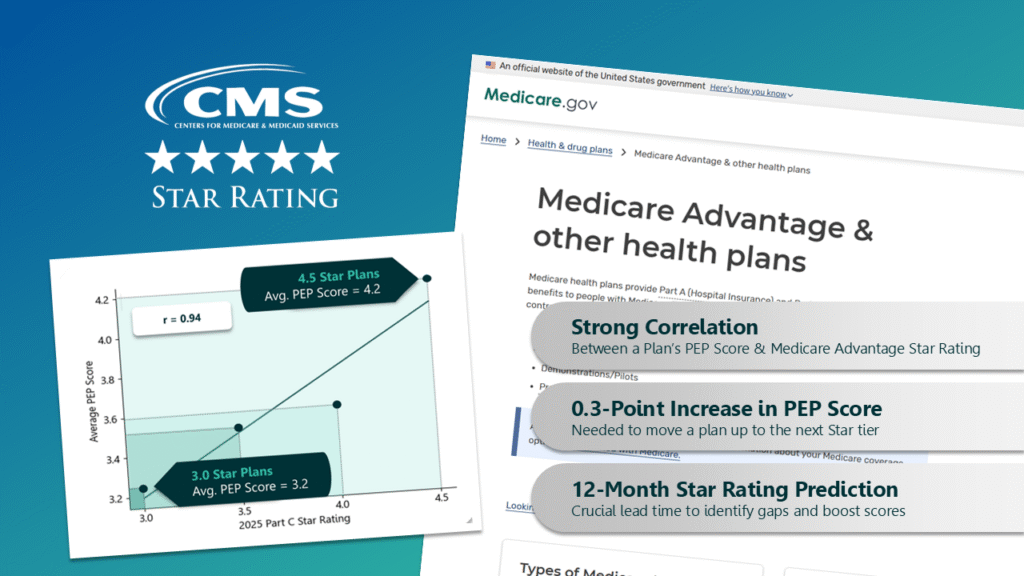

For Medicare Advantage, CAHPS and related experience measures heavily influence Star Ratings, which in turn drive bonus payments, growth, and regulatory credibility. Small movements can have outsized financial impact.

PEP Health’s validation work with a large Medicare Advantage plan showed that unsolicited patient feedback surfaced far more negative, actionable signals than internal surveys. PEP Scores from 2023 closely predicted CMS Part-C Star Ratings released in 2025, and a roughly 0.3-point difference in PEP Score separated plans in adjacent Star tiers.

That gives plans more than a year of lead time to identify and address experience gaps before Stars and revenue are locked in. The same dynamic applies to leakage and churn, where better experience and higher trust translate into stronger retention and less costly fragmentation.

Plan PEP Scores From 2023 Closely Predicted CMS Part-C Star Ratings Released in 2025

At PEP Health, we help payers move beyond being data rich and insight poor. We enable experience and trust to be measured, managed, and acted on with the same discipline applied to cost, quality, and utilization, using validated metrics grounded in the real, unprompted voice of members and patients.

That means making experience intelligence a core operating capability. Not a retrospective survey exercise, not an annual report, and not a side initiative, but a continuous, evidence-based signal that informs network strategy, value-based performance, and long-term trust.

Methodology Note

PEP Health’s experience intelligence platform analyzes unsolicited patient and family feedback from publicly available online sources, including reviews and comments related to healthcare delivery. Using AI and natural language processing models trained specifically on healthcare language, feedback is classified into seven core experience domains and multiple sub-themes within them.

PEP Scores are calculated on a standardized 1–5 scale at the provider, service line, and network level, and update continuously as new feedback is posted. Validation studies have demonstrated strong correlation between PEP Scores and established quality measures, including HCAHPS and CMS Part-C Star Ratings.

The Trust Score is derived from analysis of trust-related language within patient comments, organized into empirically identified drivers of trust, such as communication, attentiveness, and compassion, and indicators of trust, such as retention and recommendation intent.

All insights are aggregated and anonymized. No protected health information is collected or processed.